- Monday - Friday 9:00 AM - 5:00 PM

- (+61) 433 634 344

- JohnA@ireactconsulting.com

insurable solutions

- Home

- Insurable Solutions

Insurance

- Is it time to embrace Parametric Insurance?

- Pre-agreed trigger points

- Fast pay outs to speed recovery

- Works best with flood prevention measures

- Protect from low level flooding, up to 1 metre

- Insure against higher level flooding

- Incorporate with flood resilient interior designs

Smart

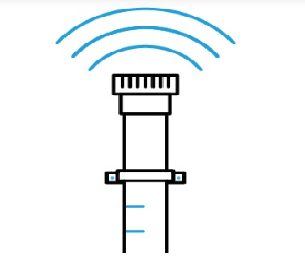

Each sensor is equipped with high-accuracy, ultrasonic depth measurement technology – a bit like the parking sensors on a car. It also has mobile connectivity to send up-to-date flood data to FloodFlash HQ.

Strong

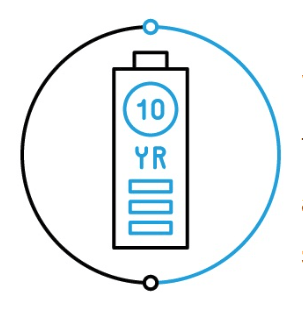

The sensor is built to last. It features a battery that lasts up to 12 years, tamper proofing and a memory chip to store data for when networks fail. It can weather almost any storm that comes your way.

Secure

This tamper-proof and fraud-proof sensor has been rigorously tested to withstand even storm conditions. Its simple installation allows for easy replacement, ensuring minimal disruption if needed.

Choose sensor location

The size and layout of the property area you choose for your cover (details provided in the statement of fact document) determine where your sensor will be placed. Need to adjust the placement? Simply request a new quote.

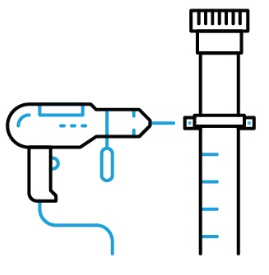

Engineer visit to install

Upon confirmation of the quote and cover purchase, an engineer will visit your property equipped with the sensor and necessary tools. Please ensure the designated installation area is clear beforehand.

Sensor health check

Upon installation, the engineer activates the sensor. The sensor then starts transmitting readings to FloodFlash HQ. These readings undergo an automated verification process to ensure proper functionality. Once verified, the sensor remains vigilant, prepared to report the first indication of flooding and initiate the claim process.

Smart

Each sensor is equipped with high-accuracy, ultrasonic depth measurement technology – a bit like the parking sensors on a car. It also has mobile connectivity to send up-to-date flood data to FloodFlash HQ.

Strong

The sensor is built to last. It features a battery that lasts up to 12 years, tamper proofing and a memory chip to store data for when networks fail. It can weather almost any storm that comes your way.

Secure

This tamper-proof and fraud-proof sensor has been rigorously tested to withstand even storm conditions. Its simple installation allows for easy replacement, ensuring minimal disruption if needed.

Choose sensor location

The size and layout of the property area you choose for your cover (details provided in the statement of fact document) determine where your sensor will be placed. Need to adjust the placement? Simply request a new quote.

Engineer visit to install

Upon confirmation of the quote and cover purchase, an engineer will visit your property equipped with the sensor and necessary tools. Please ensure the designated installation area is clear beforehand.

Sensor health check

Upon installation, the engineer activates the sensor. The sensor then starts transmitting readings to FloodFlash HQ. These readings undergo an automated verification process to ensure proper functionality. Once verified, the sensor remains vigilant, prepared to report the first indication of flooding and initiate the claim process.

You should pick a payout amount that makes sense for your business. Consider how much it might cost to make repairs to your property in the event of a flood the cost of replacing or repairing damaged stock, machinery, contents, etc

the terms and limits of any existing flood insurance you might have - for example, your existing insurance might have a very large excess for flood damages, or the level of cover provided might be insufficient for your needs.

You receive the payout for any lower trigger depths that were reached. The policy will still be in place for any higher trigger depths in your policy. If a flood were to occur at those heights later on, you would receive an additional payout at that time.

Consider investing in measures to increase your flood resilience, such as a flood management plan or flood defences. A FloodFlash policy can work in harmony with these investments to lower your premium. If you have taken steps which will reduce the overall cost of flooding, then you can choose a lower payout. If you are protected to a greater depth, then you can raise the trigger level.

One policyholder successfully reduced their premium by installing 1 metre-high floodgate on their building. The gates enabled them to raise their trigger depth to over 1 metre, delivering a policy with the same coverage amount for a much lower premium.

The Business

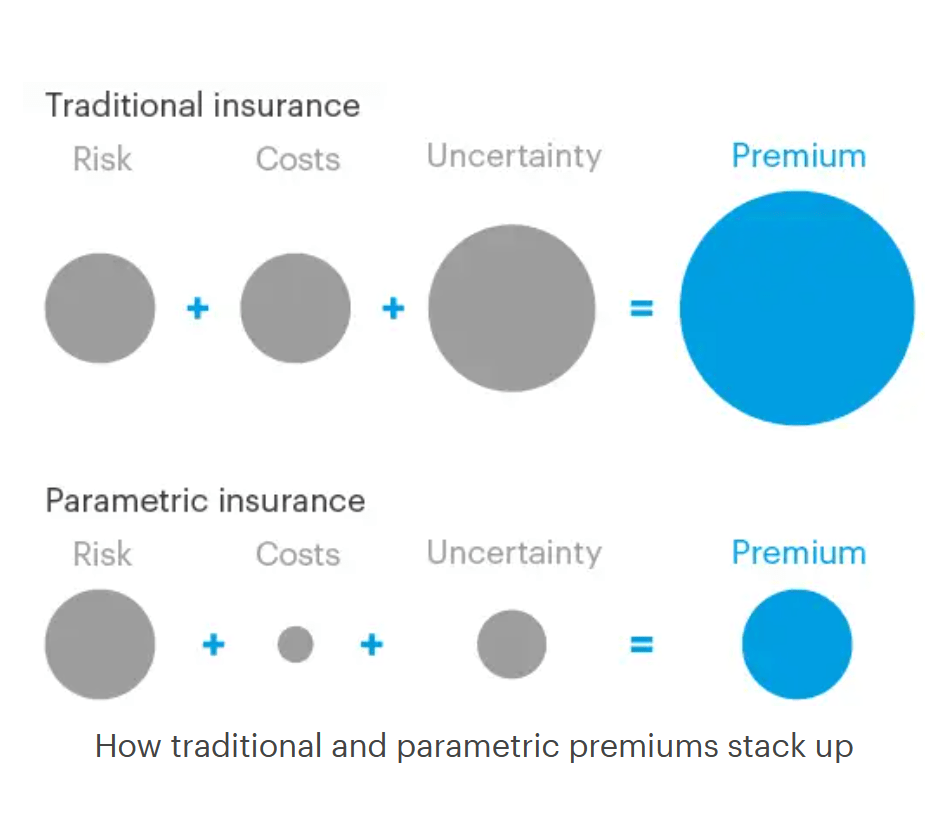

The reason why parametric insurance is affordable compared to traditional insurance is down to the costs and uncertainty associated with each policy. The costs are greater in traditional insurance because they need to pay loss adjusters, claims teams, legal or other costs. Similarly, traditional insurers are more exposed to uncertainty when a flood occurs. They can’t predict the exact damage caused by a flood because of all the variables so their final bill is unknown – and they deal with this uncertainty by charging more premium or refusing to cover flood.

A set payout is agreed upon when a flood occurs, measured using a sensor. This eliminates the costs and uncertainties associated with traditional flood insurance, allowing for significantly lower premiums.