Floods can devastate homes, disrupt lives, and leave communities facing significant challenges. Whether caused by heavy rainfall, storm surges, or overflowing rivers, the aftermath is often overwhelming. While insurance plays a part, the focus should be on resilient repairs and proactive measures that make properties insurable and secure against future floods.

In this blog, we explore insurable flood solutions and how resilient repairs enable properties to withstand the impact of flooding while encouraging insurers to underwrite coverage effectively.

What Are Insurable Flood Solutions?

Insurable flood solutions refer to strategies and structural adjustments that enhance a property’s resilience to flood damage. These solutions focus on fortifying homes to minimise damage, ensuring they meet the criteria for insurers to provide flood coverage. Unlike the technicalities of insurance policies, these measures aim to mitigate risks, helping homeowners secure their properties and improve their chances of obtaining coverage.

Examples of insurable flood solutions include:

- Elevating electrical systems and utilities: Raising electrical panels, sockets, and HVAC units above expected flood levels to prevent damage.

- Installing flood barriers and backflow valves: Protecting entrances and drainage systems from water ingress.

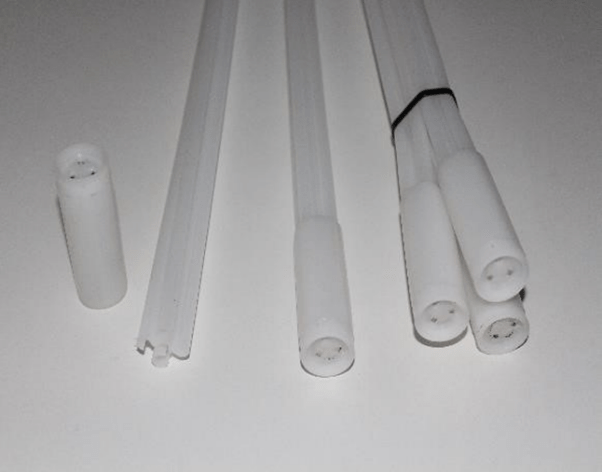

- Using flood-resistant materials: Employing water-resistant flooring, wall coatings, and furniture in vulnerable areas.

- Improving drainage systems: Enhancing landscaping and installing French drains to redirect water away from the property.

These measures not only safeguard homes but also provide insurers with confidence that the property is resilient, encouraging them to offer better terms.

Why Focus on Resilient Repairs?

Resilient repairs prioritise long-term protection over temporary fixes. By addressing vulnerabilities in construction and design, these repairs significantly reduce the likelihood of severe flood damage. This approach benefits homeowners by:

- Reducing Financial Impact: Proactive solutions minimise the extent of damages, lowering repair costs after a flood.

- Making Properties Insurable: Insurers are more likely to underwrite properties equipped with flood mitigation features.

- Enhancing Property Value: Homes with flood-resilient upgrades appeal to buyers and renters, increasing marketability.

Resilient repairs also align with sustainability, as they decrease the frequency of costly, resource-intensive restoration work.

How Do Flood Restoration Services Fit In?

Flood restoration services are vital in implementing insurable flood solutions. These services go beyond cleanup, focusing on resilient reconstruction to prevent recurring damage. Their expertise includes:

- Assessing property vulnerabilities and recommending upgrades.

- Using advanced techniques to dry and repair structures while integrating flood-resistant materials.

- Collaborating with homeowners to ensure repairs meet the standards required for insurance eligibility.

By prioritising solutions that mitigate risks, flood restoration services empower homeowners to rebuild stronger and better prepared for future events.

Steps Toward a Resilient Property

To protect your property and improve its insurability, consider these actionable steps:

- Conduct a Risk Assessment: Identify areas vulnerable to flooding and determine the most effective mitigation measures.

- Plan for Resilient Repairs: Work with flood restoration experts, like John Alexander at iREACT Consulting, to get a clear understanding on how to upgrade critical systems and structures.

- Communicate with Insurers: Share details of implemented solutions to negotiate better terms for your coverage.

- Regular Maintenance: Keep drainage systems clear and maintain flood barriers to ensure they remain effective.

Taking these steps demonstrates a proactive approach, benefiting both homeowners and insurers.

The Bottom Line

Insurable flood solutions are about more than just insurance—they’re about creating resilient homes that can withstand the challenges of flooding. By focusing on resilient repairs and proactive measures, homeowners can protect their investments and improve the likelihood of securing coverage. Flood restoration services play a key role in this process, offering expertise that ensures repairs are both effective and insurable.

With the right approach, you can safeguard your property, reduce risks, and weather the storm with confidence.

FAQs About Insurable Flood Solutions

- What are resilient repairs?

Resilient repairs involve structural upgrades and materials that minimise flood damage. Examples include raising utilities, installing flood barriers, and using water-resistant materials to fortify your property. - How can I make my property more insurable?

Implement flood mitigation measures such as improving drainage, elevating electrical systems, and using flood-resistant materials. These upgrades reduce risks and encourage insurers to provide coverage. - Are resilient repairs expensive?

While upfront costs can vary, resilient repairs are a long-term investment that reduces repair expenses after floods and enhances property value. Some measures, like improved landscaping or flood barriers, can be cost-effective. - Can flood restoration services help with resilient repairs?

Yes, flood restoration services specialise in assessing vulnerabilities and implementing solutions that reduce future risks. They also ensure repairs meet insurance standards, improving your chances of coverage. - Do I still need insurance if I have resilient repairs?

Yes, while resilient repairs reduce risks, insurance provides financial support in the event of severe flooding. Combining both offers comprehensive protection for your property.